California's Wealth Tax Sparks Tech Exodus Fears

California's proposed 5% wealth tax on billionaires, targeting assets over $1 billion, has ignited significant opposition among tech industry leaders. Figures like Alexis Ohanian, co-founder of Reddit, criticize the plan, particularly its focus on taxing unrealized gains, arguing it could severely harm the state's vibrant startup economy. Other prominent individuals, including Chamath Palihapitiya and Bill Ackman, echo these concerns, warning that the measure could stifle entrepreneurship and drive founders into bankruptcy.

The controversial proposal, which aims to fund healthcare initiatives, is prompting some of California's wealthiest residents, such as Peter Thiel and Larry Page, to explore options for relocating outside the state. Critics contend that the tax could trigger a significant exodus of capital and innovation, diminishing California's economic vitality. While the measure still requires more signatures to qualify for the November 2026 ballot, the debate highlights a growing tension over wealth taxation and its potential impact on the state's future.

Bulgaria's Euro Challenge

Bulgaria is preparing to adopt the euro on January 1st, marking its entry as the 21st member of the eurozone. This strategic move is anticipated by policymakers in Sofia and Brussels to significantly boost the economy of the EU's poorest nation and firmly solidify its pro-Western trajectory. The transition represents a crucial step towards further European economic integration.

However, the path to euro adoption is complicated by ongoing domestic political instability. Furthermore, concerns are high regarding sophisticated disinformation campaigns, reportedly linked to Russia, which are actively working to erode public trust in the new currency and the broader European project. These efforts pose a considerable challenge to a smooth and successful integration.

Donald Trump's tariffs are redirecting Chinese goods, like cars and telecoms, towards the UK market, potentially lowering inflation.

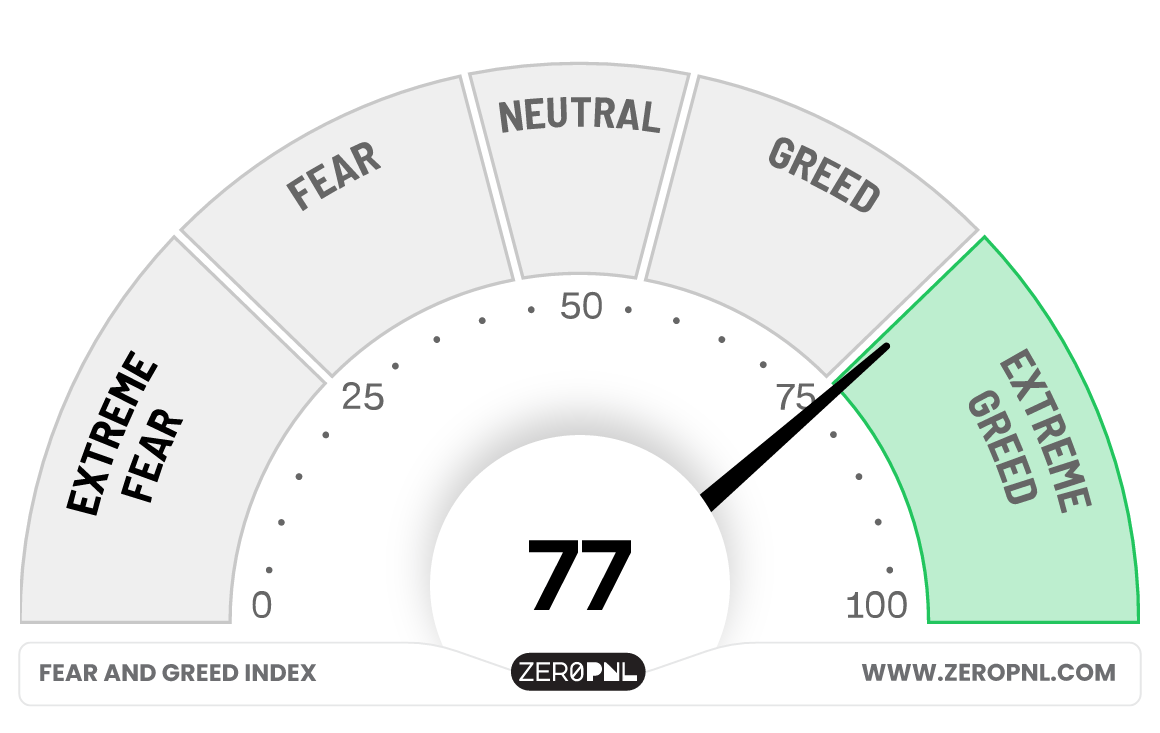

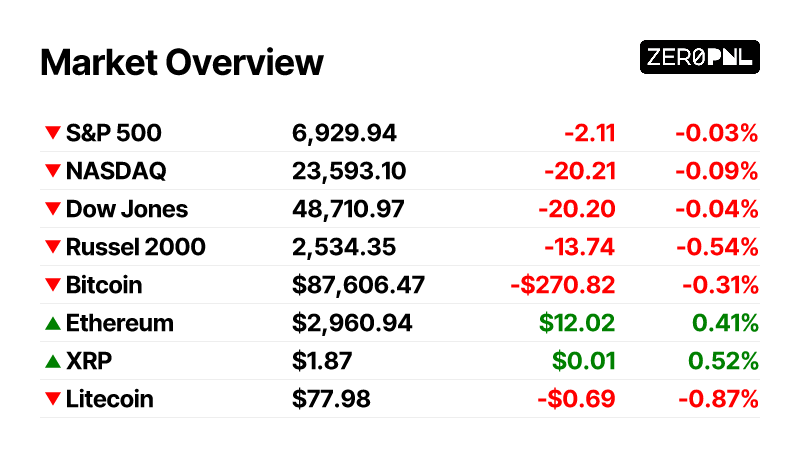

U.S. stock futures showed mixed performance on Monday, with a light week for economic data and markets closed Thursday for New Year's Day.

German businesses foresee widespread job cuts next year, particularly in the industrial sector, as global tariffs and weak exports impact Europe's largest economy.

Leading Chinese AI chatbot startups Minimax and Z.ai have filed for IPOs in Hong Kong, signaling significant growth in the AI sector.

Europe's state pension systems face growing strain from aging populations and falling birthrates, leading to political turmoil and protests across the continent.

Spain's €22.4 billion wine industry faces long-term threats from climate change, technological shifts, and critical rural depopulation, hindering new talent recruitment.

Bitcoin's Market Dynamics Amidst Precious Metal Debates

Bitcoin has demonstrated exceptional long-term performance, achieving approximately 27,700% gains since 2015, significantly outshining gold and silver. This disparity fuels ongoing debate among financial experts, with some analysts emphasizing Bitcoin's dominance while others, like Peter Schiff, advocate for shorter-term comparisons. Notably, gold reached about $4,533 per ounce and silver nearly $80 per ounce in 2025, driven by a weakening US dollar and anticipation of Fed easing in 2026.

Recently, Bitcoin's price experienced a significant breakout, briefly reaching $90,000. However, this level acted as strong horizontal resistance, leading to a retreat towards key support around $88,000. This price action coincides with a decline in silver after an initial surge, suggesting a potential shift of speculative capital into Bitcoin.

Technical analysis reveals Bitcoin is currently testing critical horizontal support at $88,000 and a major ascending trendline on the weekly timeframe. Despite potential bearish scenarios, a bounce from these support levels is considered the more probable outcome, potentially signaling a new upward trajectory. The daily Relative Strength Index (RSI) also shows a breakout from its downtrend, reinforcing a bullish outlook for Bitcoin's future movements.

Ethereum's Persistent Downtrend

Ethereum's price has shown a significant downturn since reaching an all-time high in August 2025, with the fourth quarter of the year marking a decline of over 29%. This sharp reversal from its peak performance suggests a strong bearish momentum currently dominating the market, raising concerns among investors regarding its short-term trajectory.

Technical analysis reinforces this bearish outlook, identifying a descending triangle pattern on the ETHUSD chart. This formation, coupled with a confirmed Change of Character (CHoCH) in market structure, indicates a shift towards sustained selling pressure. The cryptocurrency faces considerable resistance around the $3,000 level and is currently trading within a Fair Value Gap between $2,930 and $2,960, further restricting upward movement.

Should the current bearish trend persist, analysts project initial downside targets at $2,815. A further breakdown could lead to a more substantial decline, with the next major support level identified at $2,748. This suggests a continued struggle for Ethereum, as discussed in further detail regarding why Ethereum price will crash. These levels represent critical zones where buying interest might emerge, potentially triggering a bounce or consolidating the price.

World Liberty Financial's community is voting on a proposal to deploy treasury funds, aiming to significantly boost USD1 stablecoin adoption and expand its network effects.

Uniswap has enacted a historic burn of 100 million UNI tokens from its treasury, valued at $591 million, and will activate its fee switch in January to enhance value accrual.

Japan plans to slash crypto taxes to a flat 20% by 2026 for specified digital assets, a sharp drop from the current 55% maximum rate.

China's PBOC will require commercial banks to pay interest on digital yuan balances starting January 2026, aiming to boost adoption and utility.

Bitcoin's mining difficulty is set for another increase in early January 2026, nearing record highs as block times remain faster than the 10-minute target.

Coinbase CEO Brian Armstrong asserts that Bitcoin functions as a vital "check and balance" on the US dollar, indirectly urging policymakers towards fiscal discipline.